Budget & Finance

Fiscal Year 2025/2026 Budget Message from the Mayor Dowless

Dear Edgewood Residents,

As your Mayor, I remain committed to transparency especially when it comes to how we manage your tax dollars. With the City Council finalizing the budget for the upcoming fiscal year, I want to take a moment to share the principles guiding our decisions and how they directly benefit you as residential and commercial property owners.

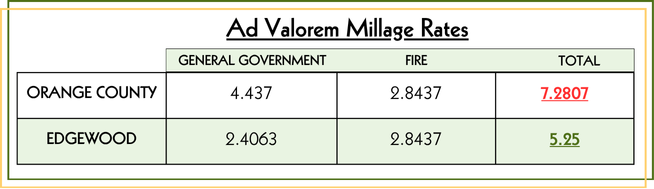

For the sixth consecutive year, Edgewood City Council has kept the millage rate at 5.25 mills. This reflects our ongoing commitment to fiscally conservative budgeting and long-term planning. City Council and staff have worked diligently to control costs, increase efficiency, and avoid unnecessary spending allowing us to continue delivering high-quality services without increasing your property tax rate. This accomplishment is especially meaningful given the financial pressures we’ve faced. Notably, the Orange County Commission approved a 26% increase in the Fire and Rescue ad valorem rate last year, now set at 2.8437 mills. Despite that, your City Council voted once again to hold the line and not raise Edgewood’s tax rate.

Understanding the Numbers: Millage Rate Comparison

It’s important to understand how Edgewood’s tax rate compares to neighboring governments. At first glance, Unincorporated Orange County’s millage rate of 4.37 may seem lower, but that figure excludes their separate Fire and Rescue tax. By contrast, Edgewood’s single 5.25 rate covers all city services, including fire and police.

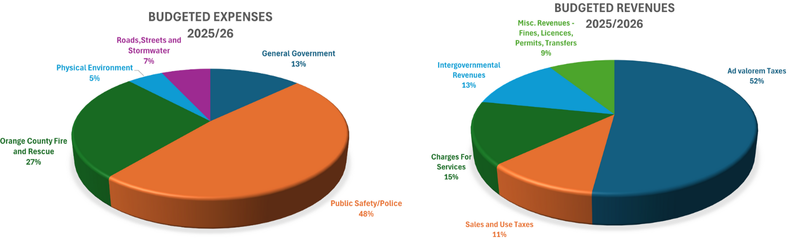

Where Your Tax Dollars Go

The City collects $2,512,538 in ad-valorem revenue each year, yet the combined costs of Fire & Rescue ($1,325,120) and Police Services ($2,331,725) already exceed that total. All other essential services, such as roads & streets, stormwater management, grounds maintenance, and City Hall operations, are funded through other revenue sources, including utility franchise fees, state revenue sharing, and non-ad valorem assessments.